Crypto market's Future in India

Crypto market’s Future in India Cryptocurrency is a digital currency that uses cryptography to secure transactions. The future of cryptocurrency in India is uncertain.

Cryptocurrency has increased in size, and investor appeal to support financial activities, including buying, selling, and trading in India and internationally.

7.3% of Indians owned cryptocurrencies in 2021, according to the United Nations Conference on Trade and Development Report 2021. As much as it is commendable that India is quickly embracing Digital in nearly every aspect of life, a real worry that needs immediate attention is that India now lacks any legal framework to oversee the market for crypto assets.

Crypto market’s Future in India:

The crypto market is volatile, with the prices of Bitcoin fluctuating daily. The Indian government has not yet taken an official stance on the legality of cryptocurrencies. As such, people are hesitant to invest. However, there is still hope for this market in India.

The absence of a regulatory framework exposes investors to expected fraud and uncertainty for enterprises trying to enter this market. Money laundering, fraud, and the funding of terrorism can all be made easier in an unregulated environment.

Read Also : Enriching mechanical engineering education with automation and robotics

Does India stand For Regulating Cryptocurrency?

- Cryptocurrency trading, mining, holding, transferring, and use are punishable in India with a monetary fine or/and a term of imprisonment up to 10 years, according to a 2019 RBI statement.

- Additionally, the RBI stated that it might eventually introduce the digital rupee as legal money in India.

- In 2020, the Indian Supreme Court lifted the RBI’s ban on cryptocurrency.

- In the Union Budget for 2022–2023, the Government of India stated unequivocally that any virtual currency or crypto asset transfer would be subject to a 30% tax deduction.

- Virtual goods and cryptocurrencies used as gifts will be taxed in the recipient’s hands.

What are the uncertainties of cryptocurrencies?

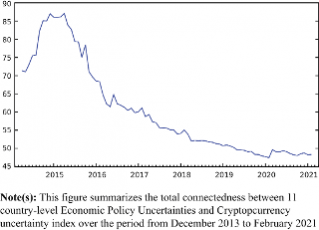

- Cryptocurrency is volatile and speculative; high investment quantities cause market volatility, which causes price fluctuations and the potential for significant losses for investors.

- Reliability and Security cryptocurrency is a digital method of exchange. It has become a popular platform for hackers, financing terrorism, and the drug trade. Because it leads to a decreased sense of Security and a lack of dependability, this has increased peoples’ fatigue to a greater degree.

- Absence of a regulatory framework, the Indian government’s approach to cryptocurrencies is one of wait-and-see. Lack of regulatory authority has increased the likelihood of fraud, endangering investor protection and money flow throughout the economy.

- Issues with the Stock Market, according to the Securities and Exchange Board of India (SEBI), it has no authority over cryptocurrency “clearing and settlement”.

- It is unable to offer counterparty guarantees as it can for stocks. Furthermore, neither money, a commodity, nor Security has been used to characterize cryptocurrencies.

- Rising cryptocurrency markets have the potential to tip the Indian economy’s circular flow of money out of balance. The process of creating cryptocurrencies differs significantly from the way the economy produces regular money.

As a Regulation, supply and demand are in balance in Cryptocurrency. For instance, only the RBI can create cash in India if the Minimum Reserve System is up and running. On the other hand, it is encrypted and secured rather than dependent on the rules of financial institutions, making it challenging to raise the money supply above a set algorithmic pace.

What should the next step be?

- Cryptocurrency Definition: According to pertinent national laws, cryptocurrencies should be defined explicitly as securities or other financial instruments.

- Linking the Startup Ecosystem to Crypto: Blockchain and cryptocurrency technology have the potential to revitalize India’s startup scene and provide employment opportunities for everyone from blockchain developers to designers, project managers, and business analysts to marketers and promoters.

The establishment of a Central Bank Digital Currency (CBDC) for India in the form of the Digital Rupee was announced by the Indian Finance Minister. It will significantly strengthen India’s digital economy. Using digital currency will also result in a more effective and affordable system for managing currencies. To fully capitalize on Blockchain technology, CBDC should coexist peacefully with other cryptocurrencies.

READ ALSO :

Future scope of Machine Learning